How I’m supercharging my savings with socially responsible investing (SRI)

Getting my finances in order has been a work in progress over several years, starting with tackling credit card debt, paying off my car loan and then building an emergency fund. After clearing those hurdles, I set more defined financial goals and plans in motion this year, including automatic deposits into new investment accounts.

Getting my finances in order has been a work in progress over several years, starting with tackling credit card debt, paying off my car loan and then building an emergency fund.

After clearing those hurdles, I set more defined financial goals and plans in motion this year, including automatic deposits into new investment accounts.

I had already been contributing the amount my employer matches for my 401(k) to a fossil fuel-free fund. But I realized that given my age, I was behind schedule to meet the recommended benchmarks for my retirement savings, and I would need the power of compound interest that comes from stock market investments to give me a better shot at a secure retirement.

Here was my dilemma: I wasn’t keen on supporting companies I don’t believe in by investing more in the stock market. So, I started looking into socially responsible investing (SRI) funds. These collections of stocks (and sometimes, bonds) exclude and/or include companies based on negative or positive societal impacts; for example, excluding tobacco companies or including more sustainable companies. However, due to varying criteria that might not encompass all of one’s values, SRI funds can still include investments in companies that might give you pause, such as tech monopolies, bottled water producers and large retailers.

Although I wouldn’t be able to completely avoid supporting companies with some questionable business practices, I could at least invest in relatively better options.

Here’s what I did to work through my misgivings and come up with an investment plan to help me achieve my financial goals sooner:

-

Playing around with online calculators such as the ones from AARP and NerdWallet helped me with my financial planning.

-

I researched different socially responsible options and talked to a broker-dealer, a financial advisor and an expert in investor protections.

-

After shopping around, I ultimately decided on investing with a robo-advisor that provides Socially Responsible Investing (SRI) options. It’s simple, low-cost and its fiduciary status legally requires it to act in my best interest.

-

I opened a Roth IRA for my retirement savings and a taxable account to save up for other financial goals.

-

I used reviews by NerdWallet, Money Under 30, and U.S. News & World Report to narrow down my options for SRI robo-advisors.

-

I found Wealthsimple’s Investing Master Class to be a particularly helpful crash course.

Everyone has different companies and industries they’d prefer not to support. By doing your research and purchasing SRI funds, you have a better chance of making money from investments more in line with your personal values.

U.S. PIRG is not a registered investment adviser. U.S. PIRG is not providing any investment advice to any recipient of this communication.

Wall St photo by Ramy Majouji, CC BY 2.0.

Topics

Authors

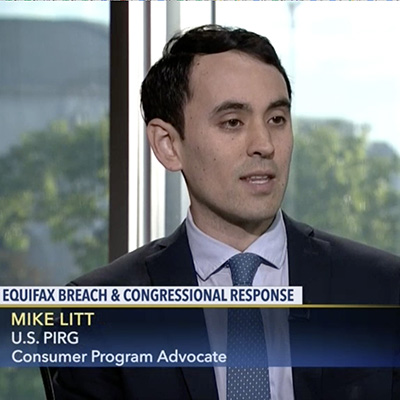

Mike Litt

Director, Consumer Campaign, U.S. PIRG Education Fund

Mike directs U.S. PIRG’s national campaign to protect consumers on Wall Street and in the financial marketplace by defending the Consumer Financial Protection Bureau, and works for stronger privacy protections and corporate accountability in the wake of the Equifax data breach. Mike lives in Washington, D.C.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

A look back at what our unique network accomplished in 2023

Avoiding scams, incorrect medical bills, privacy invasions and more