Allowing lenders to bypass consumer protections in Colorado is a clear “No”

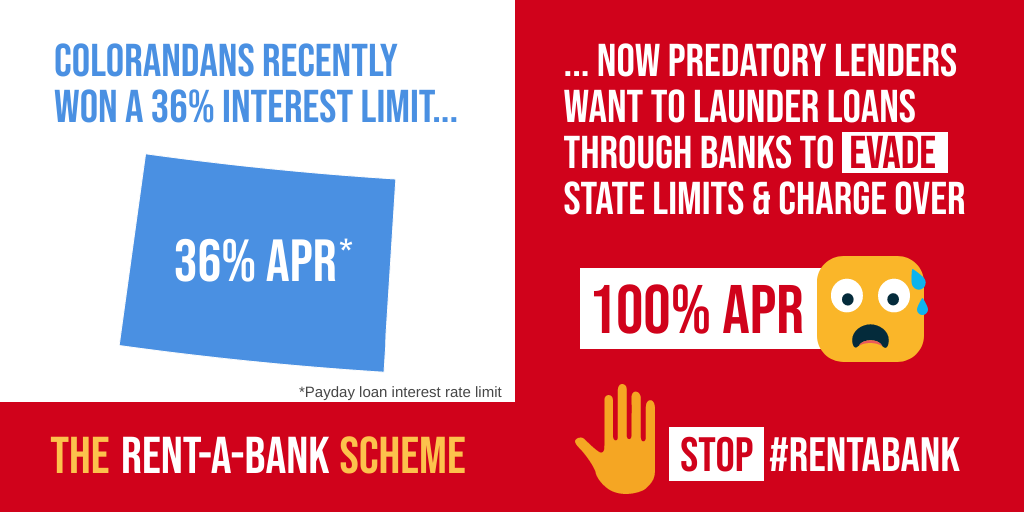

In 2018, 77% of Colorado voters voted yes on Proposition 111 to cap payday loan APRs at 36%. Unfortunately, a proposed federal rule would allow lenders to bypass our protections and charge triple-digit rates again. This is a bad idea and a coalition of organizations, businesses, and state legislators agree.

You may not have heard of the Office of the Comptroller of the Currency but this federal agency is proposing a rule that would allow banks to ignore the will of Coloradans and bypass our state consumer protections via a “rent-a-bank” scheme that would allow predatory, triple-digit APR loans again in Colorado.

With comments on this bad rule due today, I’m happy to announce that a broad coalition or organizations, along with support from consumer champions at the legislature, is pushing back.

In 2018, CoPIRG worked with a diverse coalition to close a loophole in our consumer protection statutes that allowed predatory lenders to charge fees and interest on payday loans that added up to triple-digit APRs. A payday loan is a loan where the borrower gives the lender access to their bank accounts so the charges can be taken whether the borrower has the ability to pay or not. Payday lending leads to a cycle of debt and Colordans said no in a resounding fashion, approving a 36% rate cap with 77% of the vote. The protections went into effect in Februrary of 2019.

While payday loans are $500 or less, Colorado already has restrictions on the interest and APR that can be charged to larger loans. As the loan amount gets bigger, the allowable APRs get smaller.

However, if the OCC proposed rule goes into effect, predatory lenders would be allowed to bypass our consumer protections in Colorado exceeding the 36% cap not just for payday loans but larger ones too.

In order to stop this rule, we organized and submitted a letter signed by over two dozen organizations and businesses and nineteen consumer champions at the Colorado legislature. I think the letter gives some good details on the OCC rule so I pasted it below. You can also find an analysis of the rule from our friends at Center for Responsible Lending.

We worked hard to stop the kind of predatory lending that leads people into a cycle of debt. We’re not going to stop now.

Authors

Danny Katz

Executive Director, CoPIRG

Danny has been the director of CoPIRG for over a decade. Danny co-authored a groundbreaking report on the state’s transit, walking and biking needs and is a co-author of the annual “State of Recycling” report. He also helped write a 2016 Denver initiative to create a public matching campaign finance program and led the early effort to eliminate predatory payday loans in Colorado. Danny serves on the Colorado Department of Transportation's (CDOT) Efficiency and Accountability Committee, CDOT's Transit and Rail Advisory Committee, RTD's Reimagine Advisory Committee, the Denver Moves Everyone Think Tank, and the I-70 Collaborative Effort. Danny lobbies federal, state and local elected officials on transportation electrification, multimodal transportation, zero waste, consumer protection and public health issues. He appears frequently in local media outlets and is active in a number of coalitions. He resides in Denver with his family, where he enjoys biking and skiing, the neighborhood food scene and raising chickens.