Tax & budget

Together we can make sure tax and budget decisions reflect our shared priorities and balance competing values.

Featured Resources

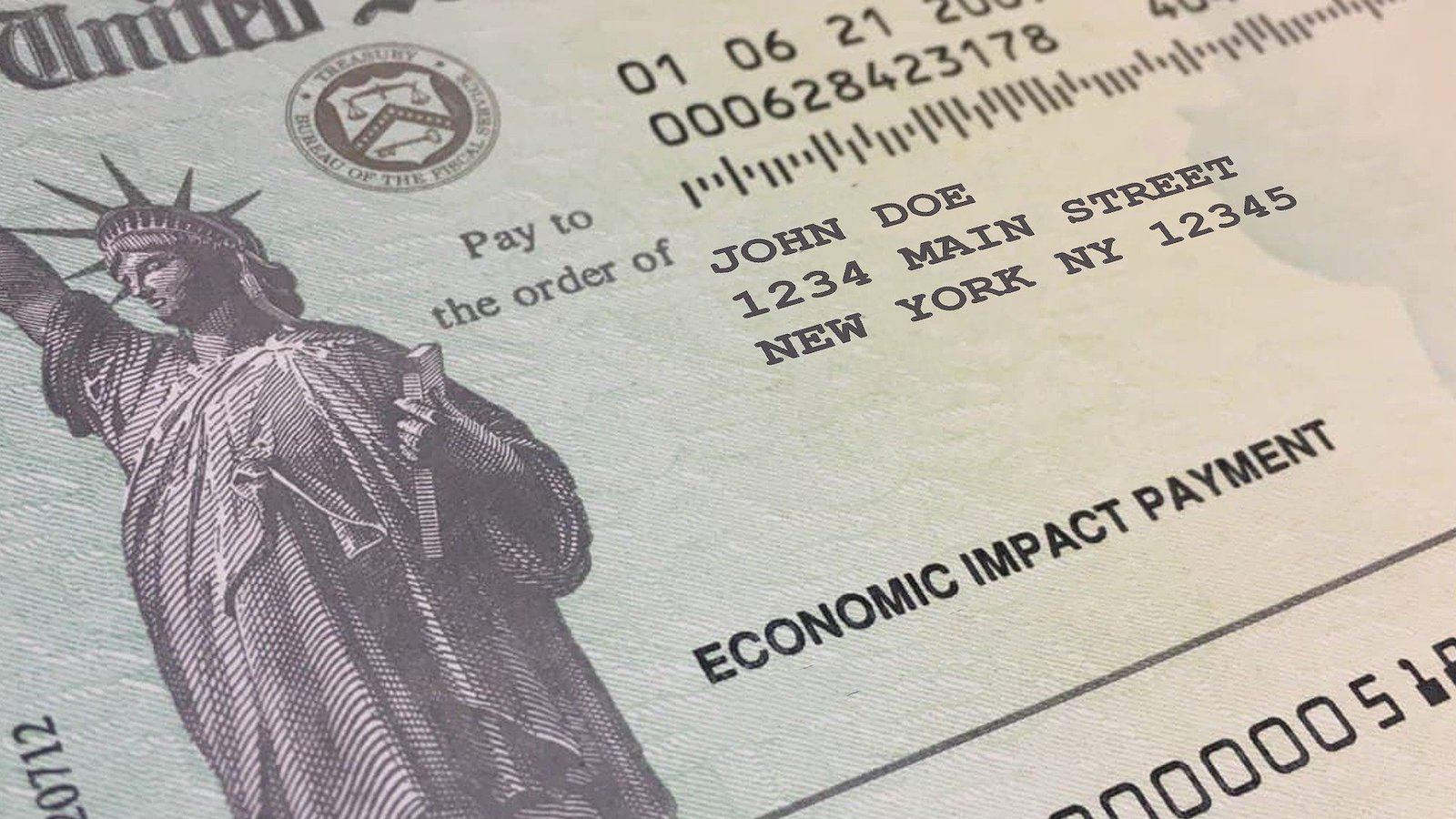

Tips to file your tax return while avoiding fees, scams

How to get your stimulus payments when you file your tax return

Fraudulent unemployment claims: You could be next — here’s what to do

The Latest

Colorado Takes Big Jump in Transparency of Government Spending

Colorado took a big jump forward in the transparency of its government spending according to Following the Money 2014: How the States Rank on Providing Online Access to Government Spending Data, the fifth annual report of its kind by the CoPIRG Foundation. After receiving a “D+” in 2013 and placing in the bottom ten states, Colorado jumped to a “B” and placed in the top 20 by implementing improvements like making over 19,000 public subsidies totaling $500 million accessible online.

Offshore Tax Dodging Blows a $504 Million Hole in Colorado Budget:

With Colorado’s state budget stretched thin, CoPIRG released a new study revealing that Colorado lost $504 million due to offshore tax dodging in 2012.